Raising rents to mitigate the impact of section 24 mortgage interest relief restrictions

First Published: July 2019 | Available in: Property Articles Your Property NetworkThe tax impact of the ‘Section 24’ mortgage interest relief restrictions – announced in July 2015 and rolling out over tax years 2018, 2019, 2020, 2021 – has by now been largely understood by the residential landlords community. However, in our experience, most landlords have focussed on how they can reduce costs and manage their mortgage expenses, but haven’t really focussed on the other aspect to their finances – raising rents to increase income. This article will focus on the financial benefit of raising rents, and how to do this in practice.

How will raising rents help to mitigate the impact of Section 24?

It sounds an obvious point, but worth making – a landlord’s profit (in fact, any business!) is the difference between income and expenses. Tax, of course, is simply a business expense, and like all business expenses should be reviewed and steps taken to reduce tax costs to the minimum possible, as more tax means less profit.

Quite rightly, since the announcement of Section 24 in July 2015, many landlords have focussed on getting their own house in order, to reduce the impact of Section 24 on their property rental business. This has included re-mortgaging onto better mortgage products, selling some properties, operating a partnership and / or property company, allocating income to family members, spending more on repairs, claiming more expenses and allowances, etc.

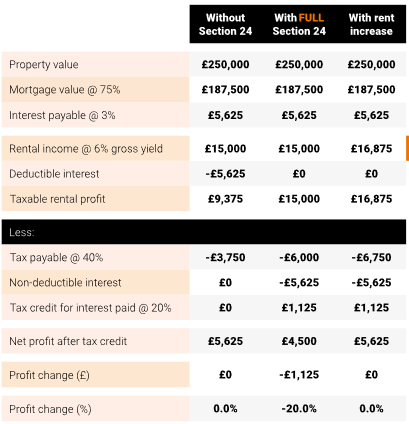

However, for many landlords, in our experience, there has been a reluctance to focus on the other variable in their rental business finances i.e. their ‘top-line’ income, their rents. This is often due to a misunderstanding about the contribution that raising rents can make mitigating the tax increase caused by Section 24 – the following is an example of the impact on an increased tax bill that raising rents can have:

Based on a property value of £250k, 75% LTV mortgage, 3% mortgage interest:

Based on the above figures, a rent increase of 12.5% will completely reverse the full impact of Section 24 for this private landlord.

Why have landlords been reluctant to raise rents to combat Section 24?

Despite what some anti-landlord commentators have stated, a majority of landlords haven’t immediately moved to raise rents for tenants. There are various reasons for this:

- The impact of Section 24 can be mitigated taking some of the ‘portfolio management’ measures mentioned above, and so there hasn’t been a need to increase rents

- Most landlords recognise the benefit of retaining a good tenant, and ‘rewarding’ that tenant by not increasing their rent (always taking care to ensure the tenant knows this was a conscious decision of course!)

- A genuine concern that raising rents should be a last resort to tenants – most landlords are decent people who are not ruthless business owners seeking to maximise profits by charging the absolute maximum rent possible! This last point is a particular bugbear for landlords who take a genuine pride in their properties, and who are decent people trying to balance their own profit with genuine concern for their tenants welfare – while feeling under attack from the Government!

The elephant in the room – can tenants afford a rent increase?

Many landlords are fairly relaxed about rents, and often rent properties below the ‘going rate’ – which certainly has some merit as a business strategy. However, often landlords don’t seek the rent that they could do, and which tenants can and will pay – which means a lower profit that could otherwise be achieved.

Before Section 24, landlords could be the ‘nice guy’ (or nice girl, naturally!) – however, there is certainly now a feeling amongst landlords that tenants need to feel some of the impact of Section 24 – not all of the impact necessarily, but there ultimately has to be some impact for tenants given in some cases the substantial tax increase that their landlord faces. In many cases landlord may be able to raise rents without making their property business no longer viable.

The reality is that many landlords are under-charging for their properties, and need to increase their rents to a level that puts their property rental business on a paying basis – the time for adopting an overly-relaxed attitude to rent levels is now over, and ultimately only those landlords who are willing to do what is necessary will survive. Really think about this last paragraph if you are serious about the property rental business that you have spent a lot of time and money building!

The reality – raising rents is PART of the solution to combatting Section 24

In reality, it is likely to be difficult to raise rents to fully combat the impact of Section 24 – however that does NOT mean that raising rents can’’ be a part of the solution.

For many landlords, Section 24 will be tackled by a combination of getting their own house in order financially, raising rents wherever possible in a sustainable way, and in many cases accepting that there will some extra tax to pay even after suitable measures are taken.

But, just like any industry that faces a significant change in its cost base, the consumer needs to accept that at least some of the cost will need to be passed on if the supplier is to maintain a viable business.

How do I go about raising rents?

Once the decision to increase the rent on a property has been made, the next questions are by how much and when. Obviously, this is a matter for the landlord to judge by looking at what the current vs market rent is, how the property compares in quality to other similar properties, what the tenant can afford, how long the tenant has been on their current rent, etc.

Some landlords will choose to raise rents by issuing the tenant with a Section 13 notice to increase the rent mid-tenancy, whereas other landlords will choose to increase the rent as and when tenants are replaced. Again, this is a question of judgement and each property can be treated differently.

Summary – don’t forget … it’s not ‘all or nothing’ !

Raising rents is just one aspect that landlords should consider when working out how to combat Section 24 – but, it’s an important and often-neglected part of the overall solution.

The key to surviving Section 24 is a combination of raising rents, reducing mortgage interest costs, selling properties, using a partnership / company, involving family members as paid employees / suppliers / partners or shareholders in the business, spending on necessary repairs, claiming legitimate expenses and allowances, making personal pension contributions, and in general working with your tax accountant proactively to ensure that you have done everything possible to mitigate the impact of what is the single biggest tax attack on private landlords since BTL was introduced in 1996, and which for many landlord is a serious threat to the very existence of their property rental business.