Landlords – don’t obsess about paying off ALL your mortgage borrowings!

First Published: March 2019 | Available in: Property Articles Your Property NetworkThe traditional residential landlords investment model has been to use mortgages (leverage) to buy properties, and so benefit from the ability to buy more property, and make more rental profit and capital gains, as a result. Mortgage interest tax relief restriction (known as ‘Section 24’), means that tax now plays a major role in the overall picture for landlords – but the fundamentals of using mortgages to magnify returns hasn’t changed.

This article looks at where the ‘sweet spot’ is for many landlords, in terms of balancing leverage and financial return, and what the benefit & limitations are in moving to a fully-unencumbered position.

Recap – why do landlords have mortgages?

Back to basics – landlords use mortgages to buy rental property to benefit from ‘leverage’ i.e. the ability to buy more property than their own cash alone allows, and so make more rental profit and capital gains than would be possible with cash alone.

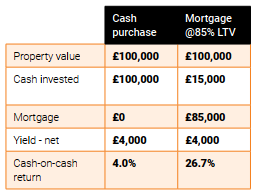

Fundamentally, as the owner of a mortgaged property, all of the capital gain is the owner’s (the lender just wants their interest but benefits from no upside capital growth), and the rental profit as a Return On Investment (ROI) on the cash invested is much higher compared to what it would be if the property was purchased for all cash.

For example: Property value £100k, net yield (after all expenses) 4%, mortgage @85% LTV.

But hasn’t Section 24 changed all that?

No – that’s the point of this article – fundamentally, the concept of using mortgages as leverage to buy more property has NOT changed, nor has the historic reasons for buying rental property. However for the purposes of this article I’ll assume that our Mr Osborne doesn’t have tax concerns (i.e. he invests in his personal name but isn’t pushed into the Higher Rate of tax by Section 24).

OK – so why shouldn’t I aim to pay off all my mortgages?

The point of this article is to highlight that when using mortgages to amplify the financial return of residential property investing, there is a ‘sweet spot’ Loan To Value (LTV) above which returns are lower, and below which returns are not significantly higher.

In the heady days of BTL, most lenders didn’t charge a higher interest rate for a higher LTV mortgage, and most lenders would lend up to 85% LTV subject to a modest 125% interest cover (e.g. if the interest payable per month was £400, then the minimum rent on the property had to be 125% of this figure i.e. £500). So, if a lenders is offering the same interest rate at 85% as they are at 60%, why would an investor NOT take the 85% LTV on offer? It would make little sense not to of course.

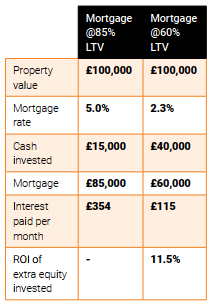

These days, most lenders charge more for high LTV mortgages (85%), and charge less for low LTV mortgages (60%).

This means that there is now a benefit in taking a lower LTV mortgage because the interest rate that applies to the whole of the mortgage is lower, which increases rental profits. However, because lenders don’t offer lower and lower rates as the LTV drops from 60% to 50% to 40% to 30% (etc), there is a ‘sweet spot’ LTV at which the interest rate bottoms out – but the rate doesn’t get lower and lower as the investor puts more and more equity into the property.

An example will help to illustrate this (Feb 2019: 85% 5-year fixed rate from Vida / Kensington, vs 2.3% 5-year fixed rate from Virgin):

OK – so, it’s OK to carry mortgages after all – but what if I have spare cash and CAN pay off my mortgages?

The point of this article is to point out that on a ‘purely mathematical’ basis, there is a ‘sweet spot’ LTV up to which there is a lot of sense in repaying mortgages, but below which there really isn’t – based on the above example, repaying further mortgage debt below 60% LTV would only save whatever the interest rate charged is (2.3%) – if lenders don’t offer a better rate than the 60% LTV rate.

But, property investing and financial management generally also has an emotional element to it – and there is a certain sense of satisfaction and comfort from having unencumbered property. No more concerns about interest rates or mortgage criteria, and no more tiresome mortgage applications – sounds great!

So, it’s not that repaying the remaining 60% LTV mortgage is a ‘bad’ investment – just that the Return On Investment of repaying the remainder of the mortgage is much lower than on repaying a mortgage down from (say) 85% to 60%. /?strong>

However, there is an argument that having a conservatively-mortgages residential property portfolio, which with decent rental yields produces a decent income, is a very nice asset to have – but that there are other investment types that perhaps should also be considered:

- ISA investments – up to £20,000 per tax year allowed – tax-free (and hassle-free) income, wide range of funds (from high to low risk), plus instant access to the funds in an emergency (unlike a pension for those under age 55)

- Pension investments – up to £40,000 per tax year allowed – with tax relief on contributions (useful for landlords looking to increase their 20% Basic Rate income tax band to combat Section 24), wide range of funds (from high to low risk), and pensions can be passed (usually) to beneficiaries without Inheritance Tax i.e. like a tax-free trust fund

- Modest emergency cash fund – say 6 months expenses. This is purely about financial protection, not Return On Investment – to protect against unforeseen expense increases or income decrease

- Repaying credit card & loan finance that isn’t cheap – again, there is potentially a lot of ‘bang for your buck’ in repaying consumer debt

A final suggestion – consider an offset mortgage account

A modern property financial product that every investor should consider is an offset mortgage account. This enables cash savings to be offset against a mortgage – so, effectively paying the mortgage off – but while retaining the liquidity of the funds in case of emergency.

Up to £85,000 of cash savings are insured via the Financial Services Compensation Scheme – so, having an £85,000 mortgage with £85,000 of savings offset gives the best of both worlds – a mortgage paid off (so no interest charged at all) but with full access to a substantial chunk of cash at the click of a mouse. For investors with an offset mortgage, there would be no need for any savings in a current account earning a paltry return – so all the investors money is working hard, but while still retaining liquidity in the event of a cash crisis.

In summary …

This article tries to highlight that when using mortgages to amplify the financial return of residential property investing, there is a ‘sweet spot’ Loan To Value (LTV) above which returns are lower, and below which returns are not significantly higher.

Some investors have a rather one-dimensional view of how to deal with mortgages – if mortgages can’t be paid off in full then there is no point in trying to repay any of them! However with lenders offering some fantastic rates for lower-LTV mortgages, there is an opportunity for investors to juggle their equity around their portfolio to get to an optimum position whereby their Return On Investment is optimised, but without the obvious huge capital required to get to an unencumbered position.