Restriction of CGT Private Residence Relief & Private Lettings Relief – impact and planning

First Published: January 2019 | Available in: Property Articles Your Property NetworkThe Autumn 2018 Budget announced the restriction of Private Residence Relief (PRR) and Private Lettings Relief (PLR), from April 2020. The tax reliefs act to reduce the CGT due on the sale of a property that a landlord has lived in – however, Government now thinks these tax reliefs are too generous, and will impose restrictions which could mean thousands of pounds of extra tax payable.

Remind me again – what is Private Residence Relief (PRR) & Private Lettings Relief (PLR)?

PRR is the tax relief that prevents capital gains made on a main residence from being taxable.

However, many properties are lived in as a main residence by the owner, and then rented either before or after the owner lived there – in these cases, some of a capital gain on sale is exempt from tax, and some isn’t.

The calculation of the amount of a capital gain that is taxable where the owner hasn’t always live in the property works on a ‘fraction’ basis i.e. by calculating the fraction of the total ownership period that is covered by PRR, in round months. As well as the actual months of occupation in a property, the current PRR rules allow the final 18 months of ownership to also be treated as if the owner lived in the property, so benefiting from PRR.

As well as PRR, a property that qualifies for PRR will also qualify for Private Lettings Relief (PLR), which is worth up to the amount of PPRE, to a maximum of £40,000, and like PRR is a per-person tax relief.

OK, so what’s changing?

From April 2020, the PRR ‘final period exemption’ of 18 months will be halved to 9 months. And, from April 2020, PLR will be abolished, except for the scenario where the landlord lives on a shared-occupancy basis with a tenant (in practice, this will be extremely rare).

Government’s view is that owners could potentially benefit from having a long (which they consider 18 months to be) final exemption period as tax relief could be claimed for 2 properties (an unsold one and a new one) simultaneously.

And, PLR was a specific tax relief brought in to encourage property owners to let their old home – clearly, in an era where Government has introduced tax changes to control the private rental sector (mortgage interest restrictions, increased SDLT on purchase, abolishing the wear and tear allowance), it makes little sense to retain a tax relief that was designed to encourage property rental.

It is worth noting however that these changes will not affect landlords who have not live in a property they are renting, and that the special exemptions for people living in or moving into a care home, or who are disabled, will not change (these cases are allowed a ‘final period exemption’ of 36 months).

OK, I think I follow it – but let’s see some numbers!

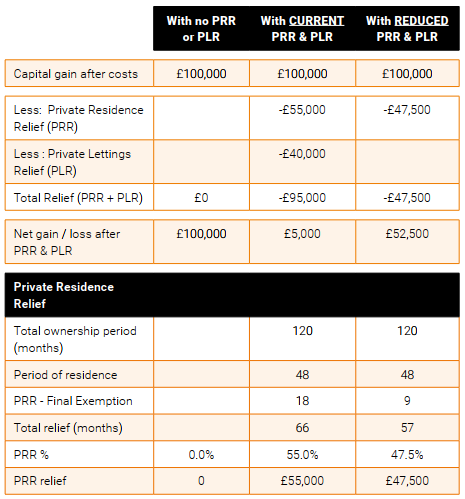

The following table sets out how the current PRR and PLR CGT tax reliefs operate in a simple example:

Single owner who is a Higher Rate taxpayer, £100k property purchase price, £250k sale price, £50k of purchase / sale / capital costs. Property owned for 10 years, lived in for 4 years, and rented for 6 years until sale:

Planning for the April 2020 PRR & PLR tax changes

As April 2020 is not far away (15 months at the time of writing – January 2019), it’s important that landlords review their residential property portfolio for any properties on which PRR & PLR may be claimed, and then assess what the impact of the new PRR & PLR restrictions will be.

In some cases the total benefit of PRR & PLR relief will be modest, and so the new restrictions will cause little concern – for example, where the taxable gain without these tax reliefs is covered by the CGT Annual Exemption(s), or where there are capital losses to use, or where a property is to be sold at a loss (PRR & PLR can’t create or increase a capital loss).

In some cases, the PRR & PLR restrictions will create an unacceptably increased CGT charge, and the landlord will need to consider whether to sell the property before the new changes apply. Crucially, this review needs to take place sooner rather than later, given how soon the changes are to be brought in.

OK- I’ve identified a property I want to sell and claim PRR & PLR at the current rates – what’s next?

So, for properties to be sold before 6.4.20, to avoid the PRR &PLR tax restrictions, consider the following points:

1. CGT Trigger = exchange of contracts

The CGT trigger point is exchange of contracts (not completion, which is the point at which SDLT is payable) – so in terms of sale timing, for CGT purposes exchanging contracts before 6.4.20 would allow full PRR & PLR to be claimed

2. Avoid unnecessary mortgage redemption charges

Take care not to re-finance a mortgage on a property to be sold – as Early Redemption Charges (“ERCs”) may be payable on the unexpired mortgage term – so it may be better to stay on a lender’s Standard Variable Rate (SVR) until the property is sold if the tax saved is more than the extra interest charged

3. Vacant possession vs ‘trade’ sale

Review whether the property is likely to achieve the best sale price if sold without vacant possession i.e. to another landlord. If not, then the tenant will need to be issued with a Section 21 notice, and vacant possession obtained – of course, this could take some time if the tenant doesn’t vacate willingly

4. To refurb or not to refurb

Assess whether a refurb is needed to get the best price on sale – and factor in the cost and time to deal with that

5. Don’t become a ‘motivated seller’!

Finally, don’t forget that properties often take time to be sold at full market value, and for many landlords it would be rather ironic if they themselves became a ‘motivated seller’, having to drop their price to hit the 6.4.20 tax deadline!

In summary …

As most landlords know, Government has been on the attack against landlords, with mortgage interest restrictions, a punitive purchase SDLT tax charge, abolishing the wear and tear allowance, and now, abolishing capital gains tax reliefs that if left in place, would act to encourage landlords to sell properties that may benefit from such tax reliefs.

However, on the positive side, many accidental and part-time landlords have now decided that enough is enough and for those landlords that stay in the game, with fewer properties available for rent and no reduction in tenant demand, the private rental sector could offer good profits for landlords who are willing to adapt to prosper.

However, in property, things often move slowly, and for those landlords who have once lived in their rental property, the loss of PRR in full, and PLR being abolished, could mean a painful extra tax charge on sale – however, by acting now, identifying any property to be sold, and beating the rush that will inevitably happen in the run-up to April 2020, landlords could liquidate equity via strategic sales and pay tax at what will in future be seen as a very acceptable level.